Weekly Crypto Report

Good morning/evening/night guys. As every Monday, find here your weekly dose on market analysis, the most relevant industry stats, and our best tips to profit from this exciting market while learning from it!

Bitcoin

we can appreciate how after the breakout it corrected a little bit more again BUT managed to hold the previous resistance as support and also defended the key $30,000 horizontal support level.

From here I think we can turn bullish again at least in the midterm due to:

- Strong response on the $30,000 support twice

- Setting a double bottom there.

- The $32,000 support also worked to push.

- Huge increase in volume during the last week

The confirmation will come with consolidation over the $35,500 resistance level.

(click here for full image resolution)

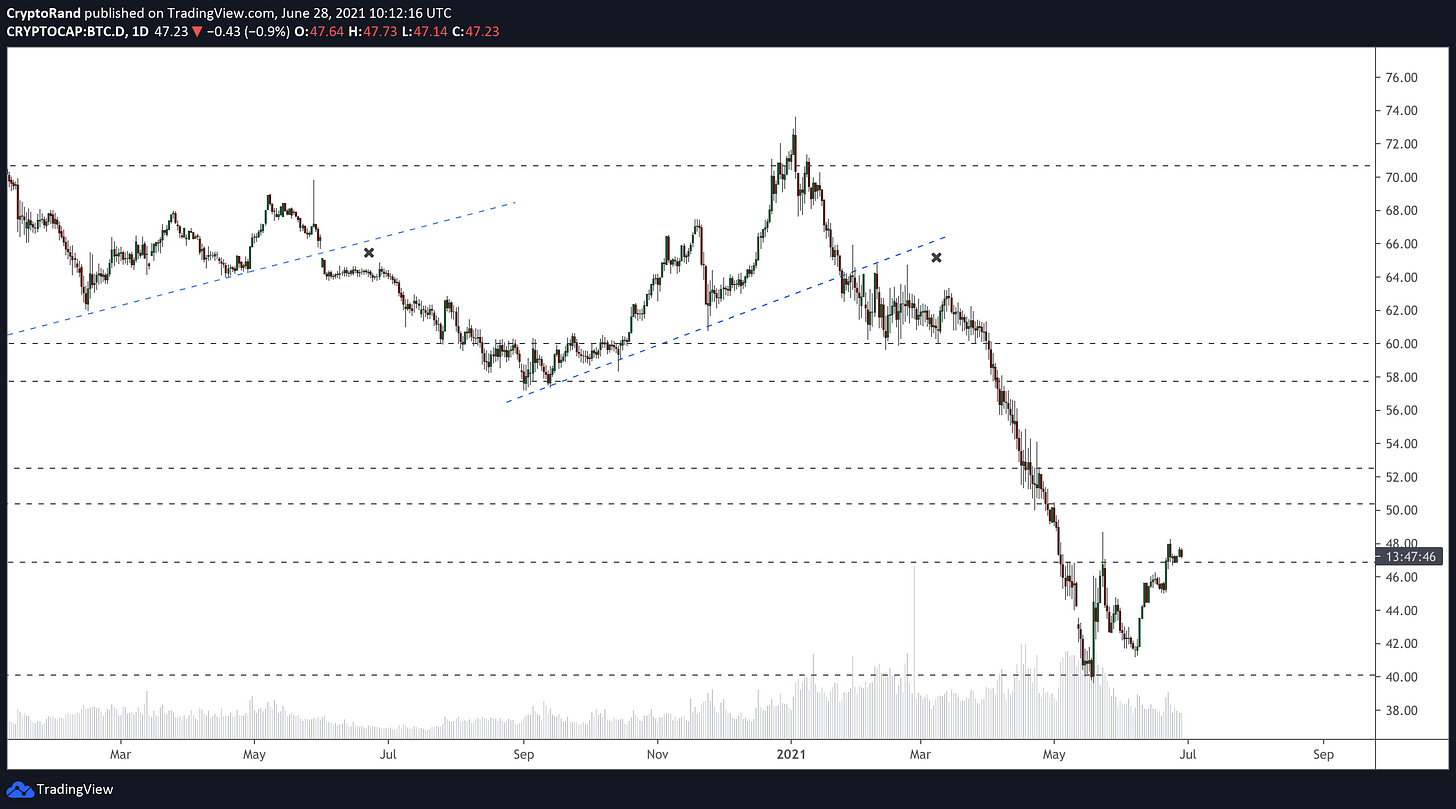

The Bitcoin dominance in the meantime continues increasing and it's consolidating above the key 47% range we commented on last week. If raises to 50% it could hit altcoins again, another reason to be careful

(click here for full image resolution)

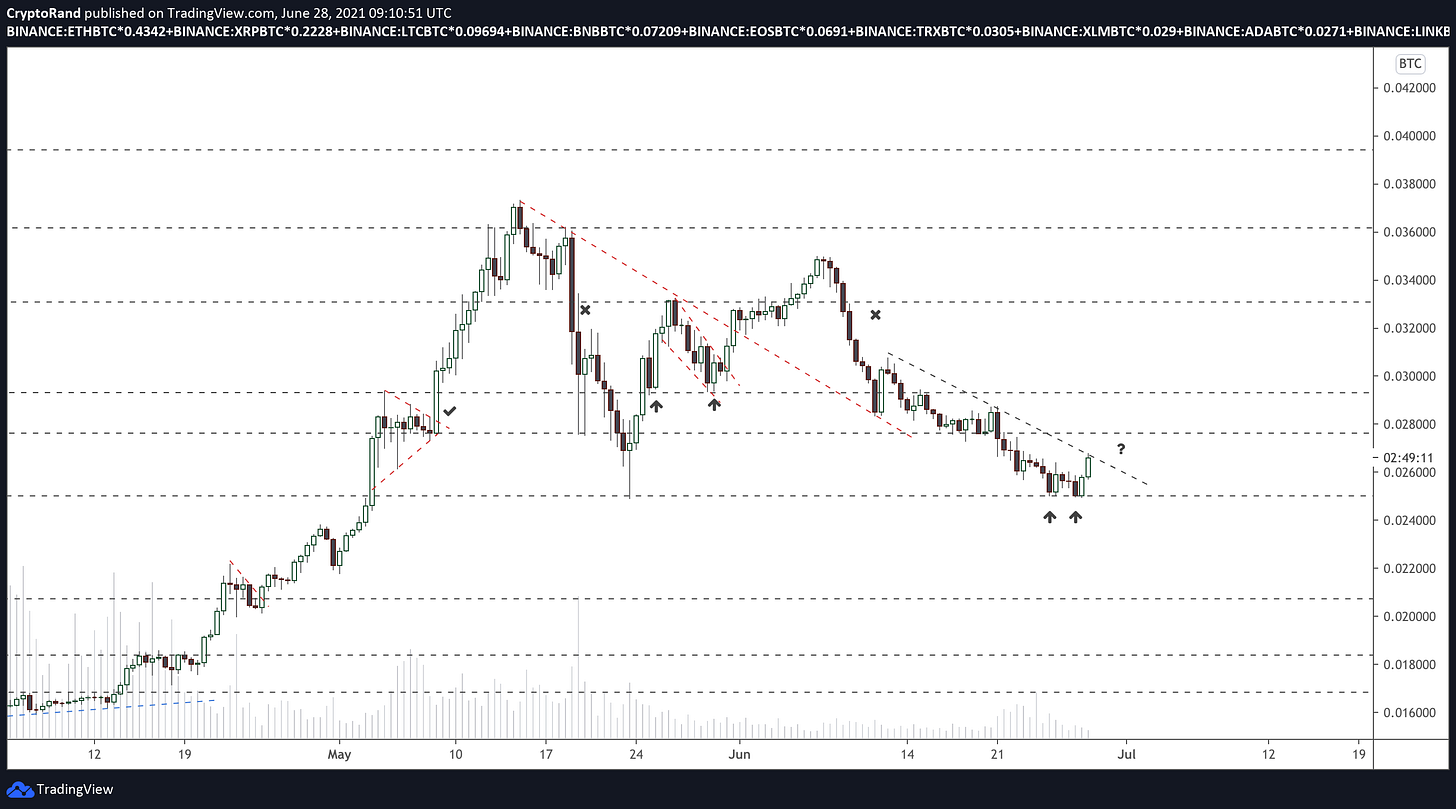

Big Caps index

Meanwhile, the Big Caps Index continues respecting the given level at 25,000 sats which we mentioned as key support. Bouncing there 4-5 days already with strength.

Now seems to be forming a local double bottom here, and getting closer to the local downtrend resistance forming since 1 month.

A breakout here would signal the bullish reversal, time to pay attention

(click here for full image resolution)

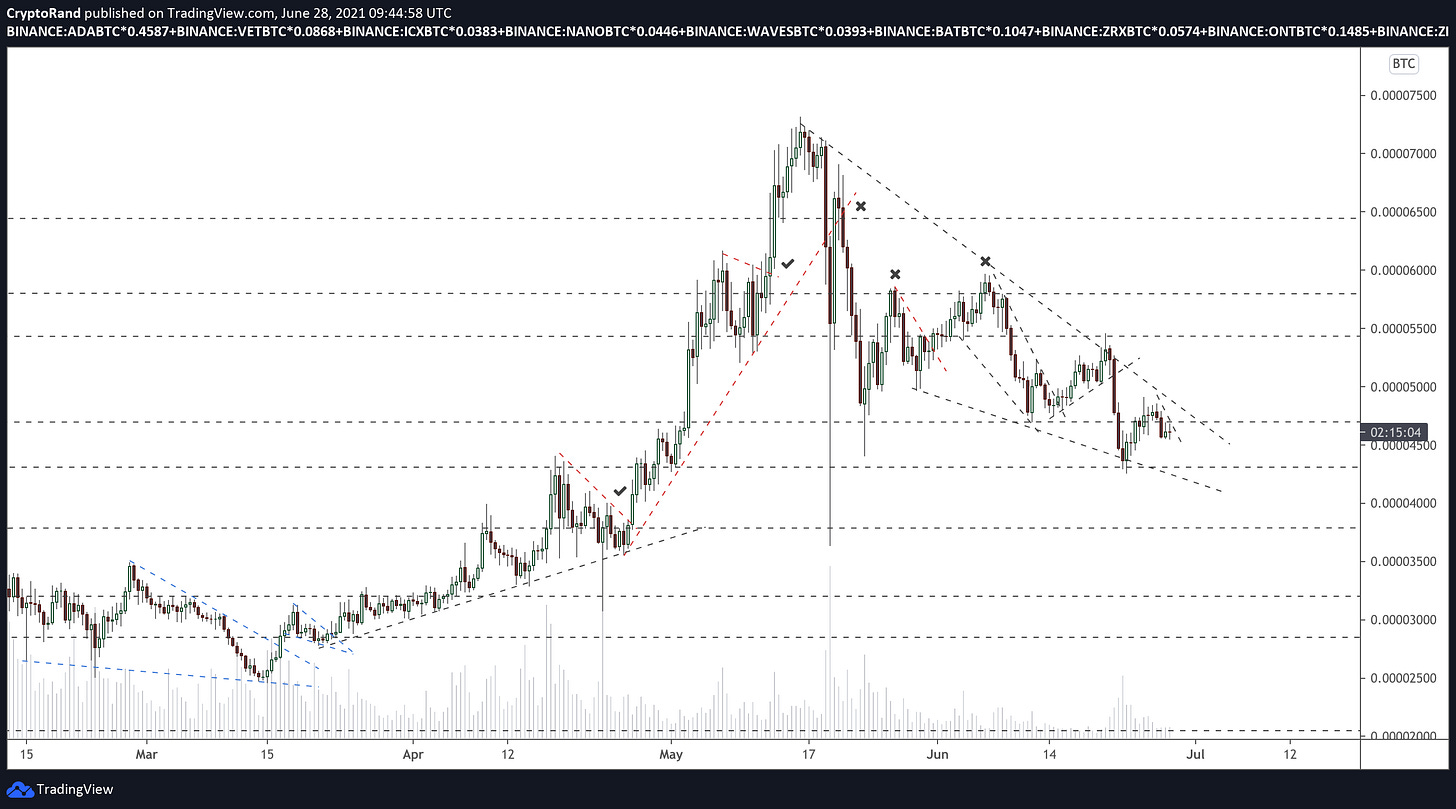

Mid Caps index

The Mid Caps Index continues looking meh to me here. Nothing relevant at all. Respected the 4,300 sats horizontal support and continues squeezing getting closer again to the main downtrend resistance. But fully lacking volume and without clear direction. I would continue waiting here, as I don't see great risk/reward to take action.

(click here for full image resolution)

The Mid Caps Index is a custom index of altcoins I've made where I aggregated ADA, VET, ICX, NANO, WAVES, BAT, ZRX, ONT, ZIL, etc weight on the formula (chart) comes determined by their market cap share.

DeFi Index

To conclude our weekly analysis now let’s take a look into the DeFi Index where we can see how the drop is slowing down and continues squeezing into the main downtrend channel confluence with the 0.035 horizontal support. A breakout here backed by a nice increase in volume would signal the reversal on the midterm.

(click here for full image resolution)

Weekly tips

Trading is a full-time business so everyone needs to learn all its ins and outs before jumping into it but as a matter of fact, people think it's easy to buy something and the next day sell in profit. They might be successful a few times this way but won't be able to stay profitable for a longer period of time.

We are all humans, driven by emotions, but you need to train yourself to avoid your trading decisions being affected by emotions. It's necessary to know what you are doing wrong. So, here, we will discuss the top 5 trading mistakes every new trader makes.

1.Trading without planning

This is something every new trader does. Without doing proper analysis they randomly buy an asset expecting it to grow in the coming days. That can be called gambling but not trading. So every time you look to trade something you need to evaluate assets fundamentals and look for some bullish chart pattern to jump into and make sure to point out the stop loss and profit targets in advance.

2. Fear of missing out (FOMO)

FOMO is another top mistake traders make. It is a scenario where price has already made a significant move and traders think it will keep moving in the same direction and jump into it without even a stop loss. Entering a trade with the feeling of missing out can not only cause a loss of capital but also affect your confidence level which can affect your future trades as well. Always define the situations and chart patterns you should trade, and stick to them.

3. Not cutting your losses

This is another big mistake made by newbies while trading. They keep holding a position hoping it will turn back into their favor. But the market is nobody’s friend, so you need to be proactive in your trading. Don't be shy of cutting your negative trades when you see a trend reversal or breakdown from a major support level. Saving your existing capital is the foremost thing a trader should look for. If something goes opposite, cut it and wait for a better setup to enter again because trading by hope will ultimately vanish your capital.

4. Too large position size

This is another mistake fresh traders do. They tend to open big-sized positions to become rich quickly and end up making huge losses. Keep the position size small so that you can easily bear the loss if it hits the stop loss. This way you will let the setup play properly while with a big position you might close the trade on a small retracement, because of your fear of loss. Your position should not be more than 4% of your trading capital.

5. Not maintaining a trading journal

Keeping records of your trades makes you sustainable in the trading business. Keep a record of your entry and exit points but also why you entered this trade. You will have a database later that you can study and improve yourself with. By logging everything this way, you might be able to figure out a high-performing trading pattern that you can use to make money non-stop or you might come to know a charting pattern that fails a lot. Hope you will take notes and will avoid these mistakes in the future. It will not only keep your trading confidence and spirits high but also will keep you profitable in your trading business.

Crypto Stats

Bitcoin number of accumulation addresses

Despite the drop in Bitcoin price, the number of addresses accumulating is on a steady rise. From Jan to Mar there was only a 2.7% increase when Bitcoin price went from $28k to $64.8k. But since making a top the growth of Bitcoin addresses accumulating Bitcoin has almost doubled to 5.8% since March even 55% drop in Bitcoin price.

Stablecoins supply on the rise

Stablecoins supply is on the rise since the launch of USDT. In the year 2020, stablecoins supply had exponential growth of 404% increase from $5.8 billion to $29.22 billion. As of 27th May 2021, stablecoins supply has been increased to $108.28 billion in the current year.

One of the main reasons for this increase is the increasing demand from people as they like to trade with stablecoins more instead of Bitcoin. And another major reason is the people transferring their profits from Bitcoin and other cryptocurrencies to stablecoins in the current year.

Top 10 Dapps on Polygon network by active users

Polygon (Matic) network has grown tremendously recently after the introduction of several new features. Various Dapps on the Polygon network are seeing more users joining every other day.

QuickSwap:

QuickSwap, a permissionless DEX based on Eth, powered by Polygon network's layer 2 scalability infrastructure is in 1st place with more than 136k active users in the last 30 days.

SushiSwap:

Sushiswap, another decentralized exchange based on Eth and supported by Polygon network's layer 2 scalability is in 2nd place with 64k active users in the last 30 days.

Polycat Finance:

A value-oriented, economically sustainable hybrid yield aggregator on Polygon is in 3rd place with 36k active users in the last 30 days.

Top 10 coins mentioned on Twitter in last week

BTC:

Bitcoin is on the top of the list with almost 2.3 million mentions on Twitter last week after having a bearish week while price hitting $28.8k.

DOGE:

Doge again had a nice hype last week after more than 40% drop and gaining back 50% is in 2nd place with more than 517k mentions on Twitter.

CAKE:

The cake is still in 3rd place with more than 323k mentions on Twitter mainly due to the continuous launch and listing of a new project on Pancakeswap.

Skin in the game

Importance of self-talk in trading

When I trade the markets, my priority is to have an honest and coherent dialogue with myself. This inner conversation will help me stay motivated throughout a trading day because it anchors how I feel about what's going on in the market. Maintaining this dialogue also helps grow self-awareness of our feelings so that we can manage them better for optimal performance as traders.

Your thoughts can have a huge impact on how you perform, so why wouldn’t you want to make the best of your self-talk by consistently aligning it with what actions are necessary for achieving success?

You know that when there is congruence between beliefs and action taken, then performance increases. This means that if you don't put in the work required to maintain alignment between your ongoing thoughts and those that foster achievement, then all efforts will be wasted!

Recently during trading, I caught a small bounce to capitalize on it. I had done proper analysis before entering but after some time when I realized that this bounce wasn't going anywhere, I immediately took data from other markets into consideration and I flipped my position to short as I already had plan B in my mind during self-talk with myself before entering the trade. This helped me maintain composure as we continued through Scenario B - which turned out not to be that bad after all.

The point of trading is not to be right, but smart. A lackluster trade that didn't work out can provide useful information for your next one! It's an investment in a better understanding of the market.

It is easy to get caught up in the ego of trading and put your own self-interest ahead of everything else. It is very important though, especially for traders who are dealing with a lot on their plate already that they have an alternative plan or idea at all times just in case something goes wrong when it comes to investing money. This means looking at what went wrong as a learning experience rather than taking things too personally - no matter how much you may want to blame others!

Have a nice day, see you soon!

Rand